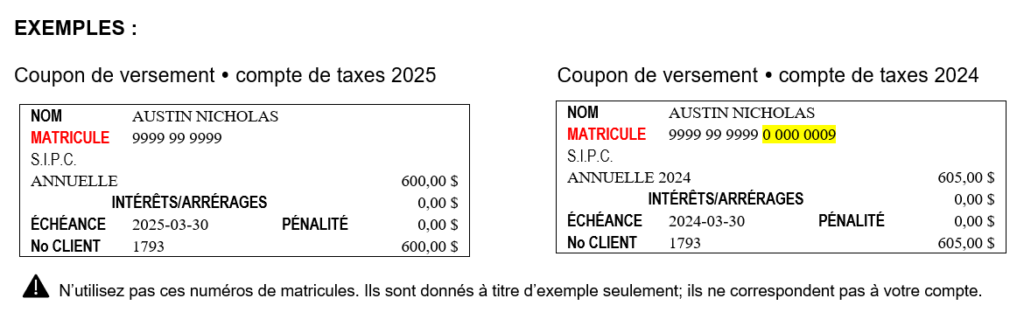

An error occured in the printing of your 2025 tax bill: the registration number (« matricule ») printed on the payment coupons at the bottom of the tax bill has only 10 digits while 18 digits are required to pay through your financial institution (that is, online).

This error does not affect persons who pay cash or by cheque.

If you are paying online, please proceed as follows:

Exception : if your property was subdivided or if lots were grouped together, you must contact Taxation at 819 843-2388, ext. 227.

CAUTION: Do not use the « matricule » numbers in the above example as they will not correspond to your tax account.

call 819 843-2388 and dial 0 (please have your tax bill in hand);

or

write to info@municipalite.austin.qc.ca, taking care to indicate the 10-digit « matricule » number or the address of the property printed on the tax bill.

We are sorry for the inconvenients this may have caused you and thank in in advance for your understanding.